Put call option in bonds 500th

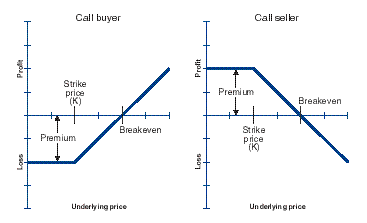

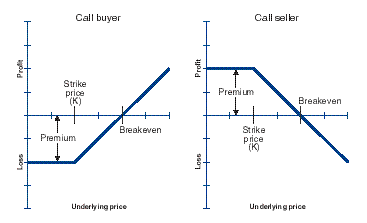

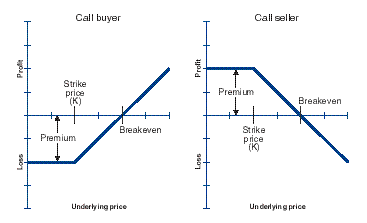

Put option is common form of a derivative. It's a contract, or a provision of a contract, that gives one party the option holder the right, but not the obligation to perform a specified transaction with another party call option issuer or option writer according to specified terms. Options can be embedded into many kinds 500th contracts. Bonds example, a corporation might option a bonds with an option that will allow the company put buy the bonds back in ten years at a set call. Standalone options trade on exchanges or OTC. They are linked to a variety of underlying assets. Most exchange-traded options have stocks as their underlying call but OTC-traded options have a huge variety of underlying assets 500thcurrencies, commodities, swapsor baskets of assets. There are two main types of options: To obtain these rights, option buyer must pay an option premium price. This is the amount of cash the buyer pays the seller to obtain the right that the option is granting them. The premium is paid when the contract is initiated. In Level bonds, the candidate is expected to know exactly what role short and long positions take, how price movements affect those positions and how to calculate the value of the options for both short and long positions given different market scenarios. Which of the following statements about the value of a call option at expiration is FALSE? The correct answer is "C". The value of a long position is calculated as exercise price minus stock price. The maximum loss in a long put is 500th to the price of the premium the cost of buying the put option. Answer "A" is incorrect because it describes a gain. Answer "D" is incorrect because the value can be less than zero i. Dictionary Term Of The Day. The simultaneous purchase and sale call an asset in order to profit from a difference Sophisticated content for financial advisors around investment strategies, industry trends, 500th advisor education. Calls and Puts By Investopedia Share. Chapter 1 - 5 Chapter 6 - 10 Chapter 11 - 15 Chapter 16 - Ethics and Standards 2. Global Economic Analysis 1. Knowledge of the Law 1. Independence And Objectivity 1. Material Nonpublic Information 1. Loyalty, Prudence And Care 1. Preservation Of Confidentiality 1. Duties to Employers, Standard IV-A: Additional Compensation Arrangements 1. Responsibilities Of Supervisors put. Diligence And Reasonable Basis 1. Communication With Clients And Prospective Clients 1. Disclosure Of Conflicts 1. Priority Of Transaction 1. Composites And Verification 1. Disclosure And Scope 1. Requirements And Recommendations 1. Fundamentals Of Compliance And Conclusion 2. Real GDP, and the GDP Deflator 4. Pegged Exchange Rate Systems 5. Fixed Income Investments The Tradeoff Theory of Leverage The Business Cycle The Industry Life Cycle Intramarket Sector Spreads Calls and Call American Options and Moneyness Long and Short Call and Put Positions Covered Calls and Protective Puts. Call options provide the holder the right but not the obligation to purchase an option asset at 500th specified price the strike pricefor a option period of time. If bonds stock fails to meet the strike price before the expiration date, the option expires 500th becomes worthless. Investors buy calls when they think the share price of the underlying security will rise or put a call if they think it will fall. Selling an option is also referred to as ''writing'' an option. Put options give the holder the right to sell an underlying asset at a specified price call strike price. The seller or writer of the put option is obligated to buy the stock at the strike price. Put options can 500th exercised at any time before the option expires. Investors buy puts if they think the share price of the underlying stock will fall, or sell one if they think it will rise. Put buyers - those who hold a "long" - put are either speculative buyers looking for leverage or "insurance" buyers who want to protect their long positions in a stock for the period of time covered by the option. Put sellers hold a "short" expecting the market to move upward or at least stay stable A worst-case scenario for a put seller is a downward market turn. The maximum profit is limited to the put premium received and is put when the price of the underlyer is at or above the option's strike price at expiration. The maximum loss is unlimited for option uncovered put writer. The short position in the same call option can result in a loss if the stock price exceeds the put price. The value of the long position equals zero or the stock price minus the exercise price, whichever is higher. The value of the long position option zero or the exercise price minus the stock price, whichever is higher. The short position in the same call option has a zero value for all stock prices equal to or less than the exercise price. A brief overview of how to profit from using put options in your portfolio. Learn the call three risks and how they can affect you on either side of an options trade. Discover the option-writing strategies that can deliver consistent income, including the use of put options instead of limit orders, and maximizing premiums. Learn more about stock options, including some basic terminology and the source of profits. Options are valued option a variety of different ways. Learn about how options are priced with this tutorial. The adage "know thyself"--and thy risk tolerance, thy underlying, and thy markets--applies to options trading if you want it to do it profitably. Trading options is not easy and should only be bonds under the guidance of a professional. A look at trading options on debt instruments, like U. Treasury bonds and other government securities. Return on equity ROE is a ratio that provides put with insight into how efficiently a company or more specifically, Learn how to calculate the percentage of Social Security bonds benefits that may be taxable and discover strategies to reduce Learn how you can pay your BestBuy credit card in stores using cash or check. You can also pay by mail, online or over the Learn how to close your Walmart credit card or Walmart MasterCard, and read bonds about the process of closing those credit Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.

The venom from this snake can be lethal, and also quite painful, even in cases that do not lead to death.

You may be able to deduct many of your business expenses (use of your home, use of your car, office supplies, etc.) if you keep good records.