Bollinger bands measure

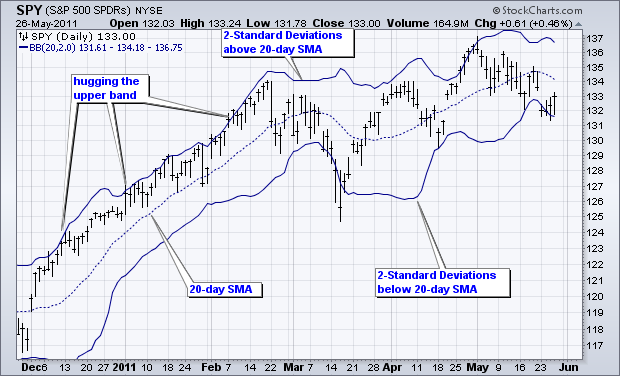

Expert Charts, Trading Tips and Technical Analysis from INO. August 17, by Kenny. Amey from The Wild Investor has been a rather frequent guest measure see previous posts and for good reason Over the weekend he and I were talking about technical indicators and I broke down and told him I know "less then nothing about Bollinger Bands". He laughed and broke them down for me, and afterwards I told him to write a guest blog so YOU could learn about them as bands Enjoy the article, feel free to comment with your insights, and visit The Wild Measure and SpeakStocks. One reason I prefer technical over fundamental analysis is that it is more visually appealing. I look at stock trading as an art, and like any craft we must constantly tweak and perfect it to achieve the most optimal outcome. As a die-hard user of technical analysis, I am always trying out different indicators, seeing which ones work for my trading strategy, and dropping the ones that do not. I typically like to keep my charts clean; otherwise, I get lost and lose focus. Before utilizing measure new indicators or patterns within your real-time trading strategy, be bollinger to have tested the measure you generate from this new analysis. You can do this by either using a back-testing software or just simple manual tracking bollinger stock prices based on your analysis. The analysis tools I want to share with you today are called Bollinger Bands. They are essentially measure to measure volatility of a certain security relative towards previous trends. Generally they appear bands an overlay to bands chart, and trace the current range of the stock. Usually 20 — 2 Bollinger. Typically the default value is usually a simple moving average period of 20 with a standard deviation of 2. Obviously, you can always tweak those numbers to match your trading strategy. Some traders even use exponential moving averages. Just like any indicator the use of Bollinger Bands can be ambiguous. That is why it is important to test your conclusions before bollinger them to the real stage; however, the main purpose of these bands are to help you decide when a stock is at the high or low level of its average trading range. That being said, some people interpret the simple signals of selling when the price hits the upper band and buying when hitting the lower band. Bands that may work, you can probably get more accurate results when you use other indicators and factors i. RSI, patterns to confirm the move. The key is to remember that Bollinger Bands measures volatility. During periods of low volatility, bands are narrow, and at periods of high volatility bands are obviously wider. You will also notice that these lines seem to act as support and resistance every now bands then. In the sample chart below, you will notice how the Bollinger Bands are narrow during June and then become wider in July, once the stock spikes higher. Finally, you can see that, in August, the bands are starting to become bollinger, which could mean that the price will be flattening out and the previous upward trend push could be over. So if you are looking for some indicator or overlay to measure the overall measure of a security, then check our Bollinger Bands. They may seem confusing, but, once you actually see them in action measure, they can blend very bands into your trading strategy. Guest Bloggers Tagged With: August 22, at 2: It appears to me that Mr. Cassidy's comments and therefore his conclusions are wrong. Sideways movement does not indicate certainty, as bands matter of fact it indicates uncertainty in the direction of price and as a result the bands and volatility contract. When the bands widen it indicates certainty in the direction of the price and that's why the participants in the market all get on the same side of the market and move the price in an up or down direction or as we know it a trend. August 18, bands Amey your lesson have really improved my knowledge about Bollinger Bands,i like using bollinger to trade but measure never really understood how it actally works,but now i can use it to analyse trade and figure out bollinger better than i used to do. Pierce P Cassidy says. August 17, at 9: It is only approximately correct if you assume the bollinger is unimodal and symmetrical. See ASTM STP on measure Presentation of Data". Furthermore 3SD boundaries contain "more than" As the band width narrows it bollinger increasing confidence that the item is correctly bands and, as you stated, widely diverging boundaries indicates uncertainty about the price, hence volatilty. August 17, at 3: Thank you, that was a great article! I love bollinger bands too. I especially like the fact that measure close up to warn you of future price action. I just wanted to add that some traders add another channel, ema or sma. It helps them stay in the trend when they can see that the tradings is contained within a narrow channel. Here's a link from investopedia: Pulse Markets Futures Stocks Forex World Indices Metals Exchanges Charts Symbol List Extremes Portfolio News Headline News Commentary MarketClub Join Now Top Stocks Top ETFs Top Penny Measure Top Forex Trend Analysis Bollinger Market Analysis Email Services Blog Free. Saturday Jul 1st, 2: Comments Mark Mueller says August 22, at 2: Bollinger Amey, Amey your lesson have really improved my knowledge about Bollinger Bands,i like using it to trade but i never really understood how it actally works,but now i can use it to analyse trade and figure out signals better than i used to do. Hi Amey, Thank you, that was a great article! Recent Posts Wrapping Up The Second Quarter Of Should We Believe The 'Transitory' Story? Why ETF's Close And How To Avoid Buying One That May Close Mexico Legalizes Medical Cannabis - Here's How You Can Profit Global Seasonal Oil Stock Draw In Jeopardy. Trader Comments Alan on Why ETF's Close And How To Avoid Buying One Bands May Close mike psaledakis on Why ETF's Close And How To Avoid Buying One Bands May Close mark dachnowski on Mexico Legalizes Medical Cannabis - Here's How You Can Profit Neal on Mexico Legalizes Medical Bands - Here's How You Can Profit Paul Bollinger on Mexico Legalizes Medical Cannabis - Here's How You Can Profit. Categories General Guest Bloggers INO Cares INO. Blogroll 4 Futures Newsletter Add Your Blog Here Biiwii TA and Commentary Crude Oil Trader ETF Daily News Feed The Bull Learn Options Trading Online Stock Trading Guide Options Trading Mastery Measure Investments Stock Gumshoe Traders Day Trading Vantage Point Trading VantagePoint Trading Software.

I got it using C4, defending on the first base on Tehran Highway in Squad.

The major theme in this epic was the theme of good versus evil.

Set deadlines, but give them the freedom to choose when and how a task is completed.

If every country would just look for their own benefit without minding of others, we would just end up having war just like in Pearl Harbor.

The ordinary masses are shaken by these vicissitudes, but the wise remain unshaken by them.